New Delhi: In a time when many investors worry about the stock market’s ups and downs, the Post Office Recurring Deposit (RD) stands tall as one of India’s most trusted saving schemes. With government backing, fixed returns, and quarterly compounding, it continues to attract families, salaried professionals, and even retirees.

But the question many ask is: How much can you really earn from it? Let’s find out.

The Power of ₹20,000 Monthly

If you invest ₹20,000 every month for 5 years, the Post Office RD at 6.7% interest (compounded quarterly) gives you:

| Monthly Deposit | Tenure | Interest Rate | Total Deposit | Maturity Amount | Total Interest Earned |

|---|---|---|---|---|---|

| ₹20,000 | 5 Years | 6.7% (Quarterly Compounded) | ₹12,00,000 | ₹14,27,315 | ₹2,27,315 |

By maturity, your ₹12 lakh deposits grow into ₹14.27 lakh — giving you a safe and guaranteed extra ₹2.27 lakh.

Why Families Love RD

- Parents use it for school fees, weddings, or building an emergency fund.

- Young professionals see it as a financial discipline tool.

- Retirees prefer it for steady, risk-free returns.

It’s like filling a piggy bank every month. Only here, when you break it open after 5 years, you find not just your savings but also a tidy bonus.

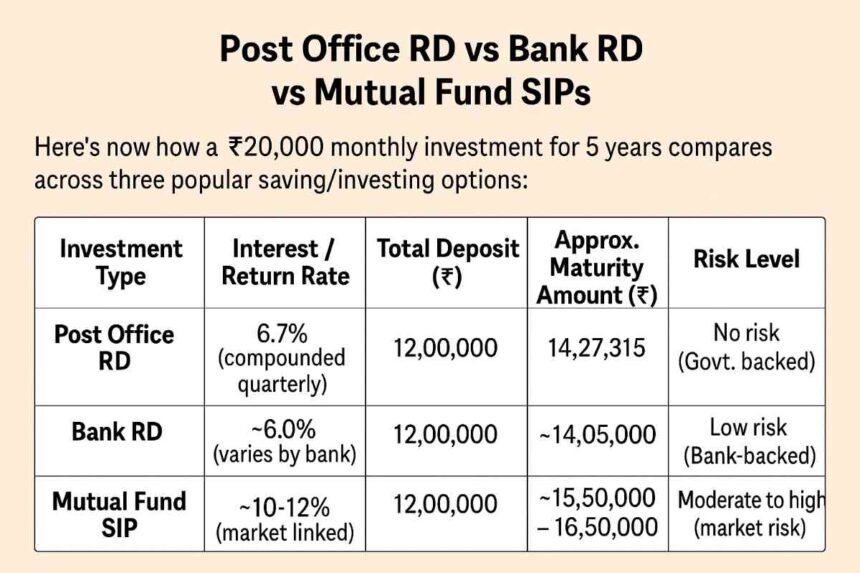

Post Office RD vs Bank RD vs Mutual Fund SIP

Here’s how a ₹20,000 monthly investment for 5 years compares across three popular saving/investing options:

| Investment Type | Interest / Return Rate | Total Deposit (₹) | Approx. Maturity Amount (₹) | Risk Level |

|---|---|---|---|---|

| Post Office RD | 6.7% (compounded quarterly) | 12,00,000 | 14,27,315 | No risk (Govt. backed) |

| Bank RD | ~6.0% (varies by bank) | 12,00,000 | ~14,05,000 | Low risk (Bank-backed) |

| Mutual Fund SIP | ~10-12% (market linked) | 12,00,000 | ~15,50,000 – 16,50,000 | Moderate to high (market risk) |

👉 Verdict:

- Post Office RD is best for safety and assured returns.

- Bank RD offers slightly lower returns but similar safety.

- SIPs can deliver higher returns but involve market risk.

Final Take

The Post Office RD is not about quick riches — it’s about steady, disciplined wealth building. By saving ₹20,000 monthly, you can safely grow your money to over ₹14 lakh in 5 years.

For those willing to take on more risk, SIPs may offer better returns. But if you want peace of mind and guaranteed income, the Post Office RD remains one of the most reliable small savings schemes in India.